See This Report about Financial Advisor Victoria Bc

The Single Strategy To Use For Investment Representative

Table of ContentsTop Guidelines Of Independent Investment Advisor copyrightLittle Known Facts About Independent Investment Advisor copyright.All About Retirement Planning copyright3 Easy Facts About Tax Planning copyright ExplainedThe Single Strategy To Use For Investment RepresentativeThe Facts About Retirement Planning copyright Revealed

“If you used to be to get a product or service, say a tv or some type of computer, you'll wish to know the specs of itwhat are its elements and what it may do,†Purda details. “You can think about buying economic guidance and support just as. Folks must know what they're purchasing.†With economic information, it’s important to remember that the merchandise isn’t ties, stocks and other opportunities.it is things such as cost management, planning for retirement or paying off debt. And like getting some type of computer from a trusted business, people wish to know they have been getting financial advice from a dependable expert. Certainly one of Purda and Ashworth’s most interesting conclusions is about the fees that economic coordinators charge their customers.

This presented true it doesn't matter the fee structurehourly, payment, assets under management or predetermined fee (during the learn, the dollar worth of costs was actually similar in each situation). “It still comes down to the worthiness idea and uncertainty regarding people’ component that they don’t understand what these are typically getting back in exchange of these costs,†says Purda.

5 Easy Facts About Investment Representative Explained

.jpg)

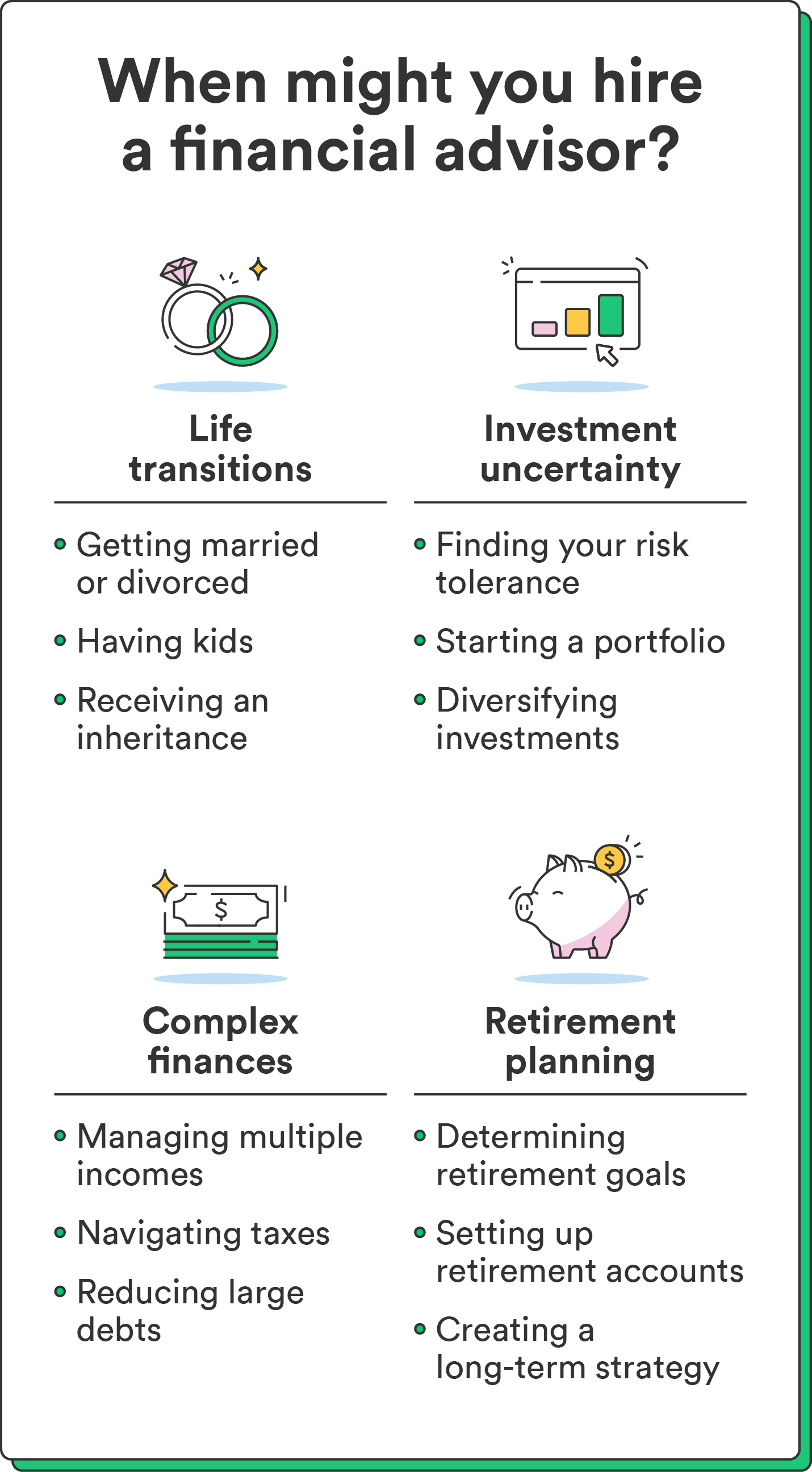

Listen to this short article once you notice the term economic specialist, exactly what one thinks of? A lot of people remember an expert who are able to provide them with economic information, specially when considering investing. That’s a good starting point, however it doesn’t color the complete photo. Not even close! Financial experts might help individuals with a bunch of additional money targets as well.

An economic specialist assists you to create wide range and protect it for all the long haul. They may be able calculate your own future financial requirements and plan techniques to extend your retirement cost savings. They are able to also advise you on when you should start tapping into Social protection and utilizing the funds in your your retirement reports to help you avoid any nasty charges.

Fascination About Ia Wealth Management

They may be able help you ascertain what shared funds tend to be best for your needs and explain to you simple tips to control and come up with probably the most of opportunities. Capable additionally assist you to understand the threats and just what you’ll ought to do to produce your targets. A seasoned expense pro will also help you stay on the roller coaster of investingeven if your opportunities get a dive.

They are able to provide you with the guidance you will need to generate an idea so you can make sure that your desires are executed. And you also can’t place a price tag throughout the reassurance that comes with that. In accordance with research conducted recently, the typical 65-year-old couple in 2022 requires about $315,000 stored to pay for health care expenses in your retirement.

The Main Principles Of Investment Representative

Since we’ve gone over exactly what financial experts do, let’s dig inside various types. Here’s a guideline: All monetary coordinators tend to be monetary experts, however all analysts are coordinators - https://nowewyrazy.uw.edu.pl/profil/lighthousewm. An economic coordinator focuses on assisting men and women make plans to achieve long-lasting goalsthings like starting a college account or conserving for a down payment on property

Exactly how do you understand which economic consultant is right for you - http://go.bubbl.us/dec75e/3e85?/New-Mind-Map? Check out activities to do to be sure you are really employing just the right individual. Where do you turn when you have two terrible choices to pick? Effortless! Get A Hold Of even more choices. The greater amount of choices you may have, the much more likely you are which will make good decision

The Greatest Guide To Retirement Planning copyright

Our Smart, Vestor plan makes it possible for you by showing you up to five economic experts who is going to last. The good thing is, it's totally free to have related to an advisor! And don’t forget to come calmly to the meeting prepared with a list of concerns to ask in order to determine if they’re a good fit.

But listen, simply because an expert is smarter compared to typical keep doesn’t let them have the ability to tell you how to proceed. Occasionally, experts are full of by themselves simply because they convey more levels than a thermometer. If an advisor begins talking-down to you, it is time for you to show them the door.

Remember that! It’s important that you and your financial specialist (the person who it winds up getting) are on the exact same page. You desire an advisor having a long-term investing strategysomeone who’ll convince you this page to keep trading consistently perhaps the market is upwards or down. private wealth management copyright. You don’t wish deal with a person who pushes you to put money into something which’s also risky or you are uncomfortable with

7 Easy Facts About Investment Consultant Explained

That mix will give you the diversification you should successfully spend for any long term. Whenever research financial advisors, you’ll most likely come across the term fiduciary duty. All of this means is actually any advisor you hire has got to work in a fashion that benefits their own client rather than their very own self-interest.